Millions risk losing savings interest because of this overlooked box on online banking forms, warn consumer advocates

There’s a moment many savers don’t notice at all: a tiny box, half‑way down a form, that quietly decides what happens to the interest on their cash. Click past it once and nothing obvious breaks. Click past it for years, and you can leave hundreds of pounds of interest stranded in the wrong place-or dribbling away in fees and tax you didn’t need to pay.

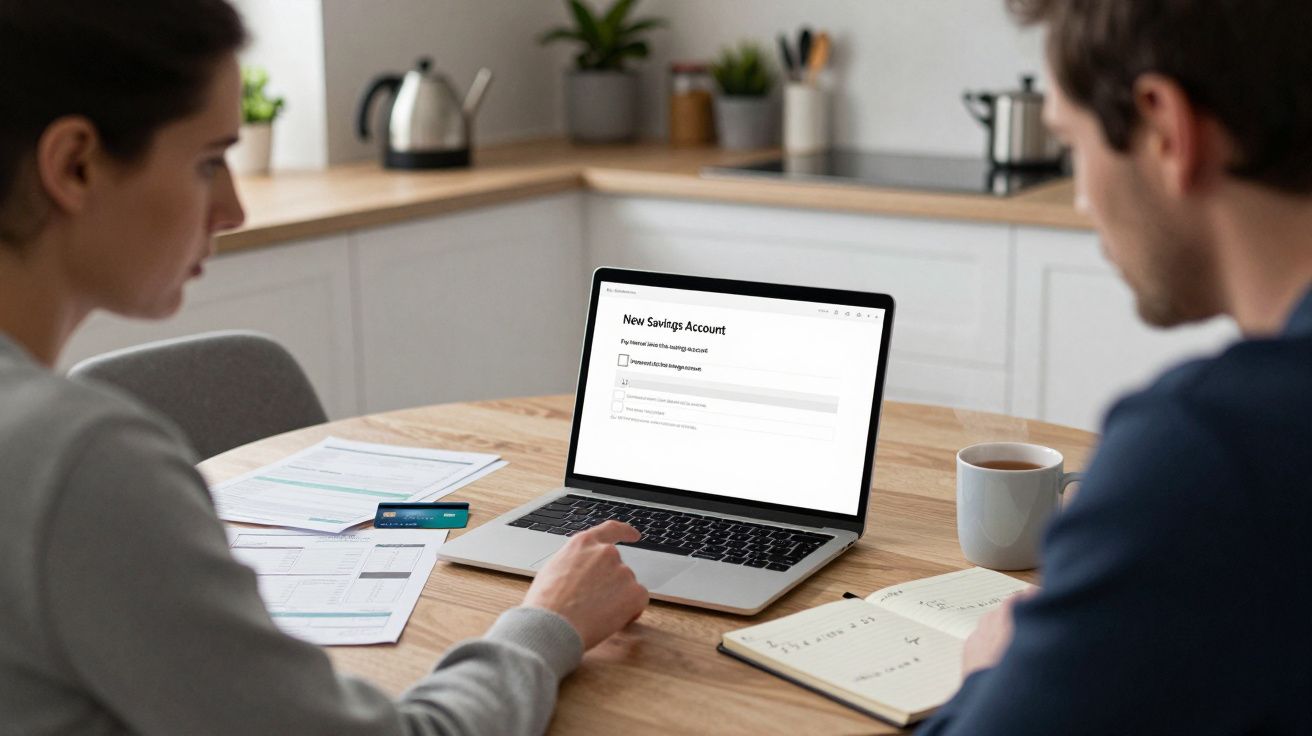

I’m watching over someone’s shoulder as they open a new “high interest” online saver. The page looks familiar: bold rate at the top, summary of features, then the usual stack of tick‑boxes. Scroll, scroll, next. They don’t see it-the line that asks where interest should be paid, defaulted to “current account ending ••••1234”. Their current account pays nothing on credit balances and charges if it creeps into overdraft. The saver does what most people do: leaves it alone and clicks “confirm”.

Consumer groups say that quiet default is costing savers money every single month.

The tiny tick that moves (or loses) your interest

On many online banking forms, there’s a small choice that determines what happens to the interest you earn:

- Credit the interest back into the savings account (compounding).

- Pay it out into your current account or another external account.

- In some cases, leave interest in a low‑rate “holding” pot by default.

The box often comes pre‑ticked with “pay to linked current account”. That might suit someone who lives off their interest. For most savers building an emergency fund, it’s a slow leak. Interest paid out instead of rolled up means you lose the snowball effect of compounding. Over five to ten years, especially at today’s higher rates, that gap gets large enough to matter.

There’s a second trap. If your current account regularly dips into overdraft, “pay interest to current account” effectively feeds your bank charges. Your savings work to plug a hole instead of growing in a ring‑fenced pot. It feels invisible because you never see money “leave” the saver; you just never see it stack up either.

“People focus on the headline rate and miss the mechanism,” says Raj Gill, a money adviser with a national debt charity. “The form lets them throw away the benefit with a single pre‑ticked option.”

Three key decisions hiding in the small print

Before you open, switch, or tinker with a savings account online, pause on three specific choices. They often sit together on the same screen:

- Where interest is paid.

- How often interest is paid.

- Whether the account is set as your “main savings pot” or a side pocket.

1. Where should the interest go?

For most long‑term savers, “add to this account” is the default that actually helps you. It keeps the money ring‑fenced and builds compound interest without you having to remember to move it. If you’re using a saver to feed bills or top up a low income, paying interest into your current account can make sense-but decide it, don’t let a bank decide for you.

Check existing accounts too. Log in, open the account details, and look for:

- “Interest destination”.

- “Interest payment instructions”.

- “Interest paid to”.

If you see your current account listed and you don’t want that, change it. Some banks allow a mid‑year switch; others only alter it from the next interest cycle. Either way, you stop the quiet leak.

2. How often is interest paid?

Monthly, quarterly, annually-it sounds cosmetic, but the timing changes how you feel about the account and, in some products, the rate itself.

- Monthly interest, added to the same account, smooths growth and helps those who like to track progress.

- Annual interest sometimes pays slightly more, but only if you leave the money untouched all year.

- Monthly interest paid out to a current account can jeopardise benefits if you rely on them for means‑tested support, because it looks like regular income.

Read the line under the rate, not just the headline. Some “monthly interest” versions of the same account pay a fraction less. If you’re not living off the income, the “interest added annually to balance” version can be more efficient.

3. Is this actually your main savings pot?

Banks now nudge you to open multiple “spaces”, “pots” or “goals”. Buried in that setup is another overlooked box: “Set as default savings account” or similar. Tick it blindly and any spare change sweeps into a pot that may pay less interest than your top fixed‑term or best easy‑access account.

The fix is simple:

- Nominate your highest‑rate flexible account as your default savings pot.

- Use named sub‑pots within that if your bank offers them, rather than separate low‑rate accounts.

- Keep fixed‑term or notice accounts separate and deliberate, not the place loose cash falls into by accident.

A five‑minute check that protects years of interest

You don’t need a spreadsheet or a finance degree. A short, methodical pass through your online banking can catch most of the costly defaults.

Walk through each savings account and jot down:

- The current interest rate.

- Where interest is paid.

- How often it’s paid.

- Any “linked account” it feeds automatically.

Then adjust using this quick order of attack.

Step 1: Stop interest feeding overdrafts

If any saver pays interest into a current account that frequently goes below zero, change it to “add to this account” or another positive‑balance saver. Otherwise, your long‑term savings quietly subsidise overdraft fees and interest.

Step 2: Align interest with your real goal

- Building a buffer, house deposit, or holiday fund in the next 1–3 years? Favour interest added to the same account, monthly or annually.

- Relying on interest for bills? Keep payout to your current account, but note the amounts so you can evidence them if benefits or tax questions crop up.

Step 3: Make your best rate the main landing zone

In your app, find “default savings” or “main savings pot” settings. Point them at:

- An account with a competitive rate.

- Easy access, if you dip in and out.

- FSCS protection (or the relevant depositor scheme) for your total balance.

Then close or empty any zombie pots paying a token rate. They clutter your view and invite mistakes.

Before you hit “confirm”, give yourself a three‑second pause: account name, interest destination, frequency. That tiny ritual catches most mis‑ticks.

Common slip‑ups that quietly cost you

Consumer advocates say the same small mistakes appear again and again in complaints and case files. None of them feel dramatic at the time.

- Letting loyalty accounts linger: Old “bonus” savers dropping to 0.1% while newer accounts at the same bank pay much more, simply because the customer never re‑ticked a box to move.

- Treating ISAs like ordinary savers: Having interest from a tax‑free cash ISA paid into a taxable current account, breaking the shield and wasting allowance.

- Splitting savings too thinly: Opening multiple low‑rate pots to “organise goals” instead of using labelled sub‑pots inside a single high‑rate account.

- Ignoring joint vs solo settings: Interest from a joint saver pushed into one partner’s personal account, complicating tax reporting and, in some cases, benefit assessments.

A lot of these issues can be fixed, but only going forward. Banks rarely recalculate years of missed compounding because a default suited them more than you.

What banks are doing-and what you can ask for

Banks argue that they provide choice: savers can direct interest wherever suits them. Campaigners counter that choice without clarity is friction disguised as flexibility. Interfaces tend to highlight the rate and hide the route that rate takes into your life.

Behind the scenes, banks are:

- Nudging customers towards app‑based management, where settings are easier to change-but also easier to mis‑tap.

- Introducing “sweeps” that move surplus current‑account cash into low‑risk savers overnight, often with preset destinations.

- Applying different rates to otherwise similar products depending on payout frequency.

You’re not powerless. You can:

- Ask your bank to explain, in writing, where interest from each of your accounts is currently paid.

- Request a switch of interest destination and, if you feel misled, log a formal complaint.

- Use comparison sites and consumer advice tools to check whether your rate and structure are still competitive.

In most straightforward cases, you won’t get back lost compound interest-but you can stop losing more from the next payout onward.

Quick toolkit: boxes to check on every savings form

| What to check | Where to look | Why it matters |

|---|---|---|

| Interest destination | “Where should we pay your interest?” | Controls compounding and whether cash leaks to low‑rate or overdraft accounts. |

| Interest frequency | “Paid monthly/annually, to…” | Slight rate differences, cash‑flow impact, and how easy it is to track growth. |

| Default pot flag | “Set as main savings account” | Decides where spare cash and sweeps land by default-often at the wrong rate. |

Going further without complicating your finances

Two accounts, two roles. One simple structure works for many households:

- A main easy‑access saver: best rate you can find, interest added to the balance, set as your default savings pot.

- A “spending buffer” saver: lower balance, interest paid out to your current account monthly if you like the psychological boost.

Keep fixed‑term or notice accounts for specific goals only. Label them with the year and purpose (“Car 2027”, “Deposit 2028”) so you remember why the money is locked and don’t panic when you can’t withdraw instantly.

Review your settings once a year-at the end of the tax year or just after a rate change email. Not every tweak will add hundreds to your balance. But turning off the quiet leaks and making one or two clear choices about those overlooked boxes can restore the feeling that your savings are actually working for you, not just sitting there politely while the bank decides the rest.

FAQ:

- Is it always best to have interest added to the same account? For long‑term saving, usually yes, because of compounding. But if you need the money each month for bills, having interest paid to your current account can be more practical-just be sure that’s a deliberate choice.

- Can I change where my interest is paid after I open the account? In most cases, yes. You can usually change the interest destination in your app or by secure message. The change may only take effect from the next interest cycle, not retrospectively.

- What about tax on savings interest? Most people are covered by the Personal Savings Allowance, but higher‑rate taxpayers can be caught out when interest jumps. Having a clear view of where interest lands makes it easier to report accurately and, if needed, shift more into ISAs.

- Does this apply to cash ISAs too? Yes. Cash ISAs often let you choose whether interest is added to the ISA or paid out. To preserve the tax advantage, it’s generally better to keep interest inside the ISA unless you rely on it as income.

- How often should I review these settings? A quick annual check is enough for most savers, plus any time you open a new account or the bank emails about a rate or terms change.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment